Today’s legal clients want options. They usually find attorney help online, they want to be able to engage in flexible communication methods like video conferences and virtual calls, and they want to stay safe when pandemic restrictions on in-person interactions are still in place. Modern clients also love the ability to access their case information from anywhere.

Being able to pay virtually is a priority for many clients. Here’s why you should consider virtual payments for your law firm.

Why offer virtual payment options?

The world has shifted to depend on virtual tools and new technologies, especially over the last year during COVID-19. This means that even payments and legal transactions have been conducted online to avoid in-person contact and provide greater convenience for clients. But virtual payments also speed up processes, and you can get paid a lot faster.

Showcasing that you offer virtual payment methods lets your clients and potential clients know that you run a modern practice and take advantage of the latest tools to streamline your workflows.

The most common payment platforms include Zelle, PayPal, Venmo, Apple Pay, and Samsung Pay. These tools can be accessed as apps on clients’ smartphones, making it convenient for them to pay no matter where they are. However, many attorneys opt for payment tools designed specifically for lawyers to avoid hidden fees and for a more streamlined client experience.

How to showcase flexible payment options

So, how do you let people know you accept online payments? A great place to start is highlighting these options on your online directory profiles, website, and other online spaces where you generate leads. In consultations, let clients know that you’re willing to work with them no matter the payment app or credit card they prefer using, if possible.

When you create a profile on the Modern Attorney directory, you’ll be able to highlight the payment options you accept so clients know they’ll be able to use their favorite platforms.

Software that can help with payments

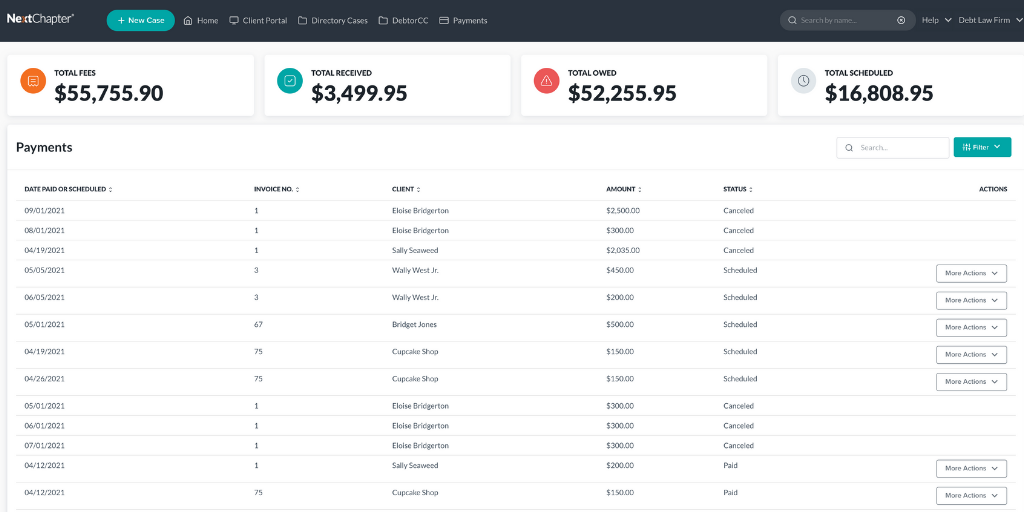

Using software with a payment feature is a big plus for your bankruptcy law firm. For example, NextChapter Payments gives you the flexibility to manage your billing online. Create invoices and payment plans, invite clients to view and pay fees with their debit card, ACH, or other preferred methods in our innovative Client Portal, and receive a receipt of payment via email.

Using our Payments dashboard, you can keep track of all received, outstanding and upcoming fees. You can also track your billable hours in NextChapter so you can bill clients accurately and quickly, and keep tabs on how much time you’re spending on each case.

Learn more about how you can streamline your billing processes, get paid faster, and increase client satisfaction with a tool like NextChapter Payments today!