NextChapter is excited to be partnering with DebtorCC.org, where debtors can complete both the first and second course requirements when they’re filing for bankruptcy.

The Bankruptcy Abuse and Consumer Protection Act of 2004 (BAPCPA) requires that debtors complete financial training courses to help them change their approach and be better prepared for the future. This partnership makes the education process fast and seamless for you and your clients.

Benefits of the integration

When you already use NextChapter for client communication and case management, it’s never been easier to ensure debtors fulfill their education requirements under BAPCPA.

Instead of having to communicate with your clients about their completion of the courses via email or fax, this new integration allows for a seamless connection between a DebtorCC account and our bankruptcy software.

Your clients may already be overwhelmed by the bankruptcy process, and the Debtor CC integration makes their life easier. The platform is modern and easy to understand for your clients. Your bankruptcy debtors will move through the credit counseling course and ultimately learn better financial habits. And at the end, they will simply chat a member of Debtor CC to get their certificate. No faxing, mailing, or emailing. You and your client will have peace of mind knowing that you have access to all of the information on the web.

As their attorney, you can keep tabs on their progress and whether they’ve completed the course, right in NextChapter's bankruptcy petition preparation software. And to limit the amount of manual work on your end, NextChapter will import the certificate and course completion date into the bankruptcy case, saving you time and energy.

How the DebtorCC integration works

The first thing you need to do is create a DebtorCC account if you don’t already have one. Then link your NextChapter and DebtorCC accounts seamlessly. You can take advantage of this integration for each of your clients.

When it’s time for a client to complete their credit counseling requirements, you simply send the invitation through NextChapter with a click of a button. They’ll receive an email with steps to get started. You can customize each invitation and include your firm’s logo and information on each, so they’ll know they can trust the invite.

Through NextChapter, track your clients’ progress in the Debtor CC portal section of the app and follow up with them via text with NextMessage if needed. The portal also allows you to view key information for all of your bankruptcy clients taking the credit counseling course.

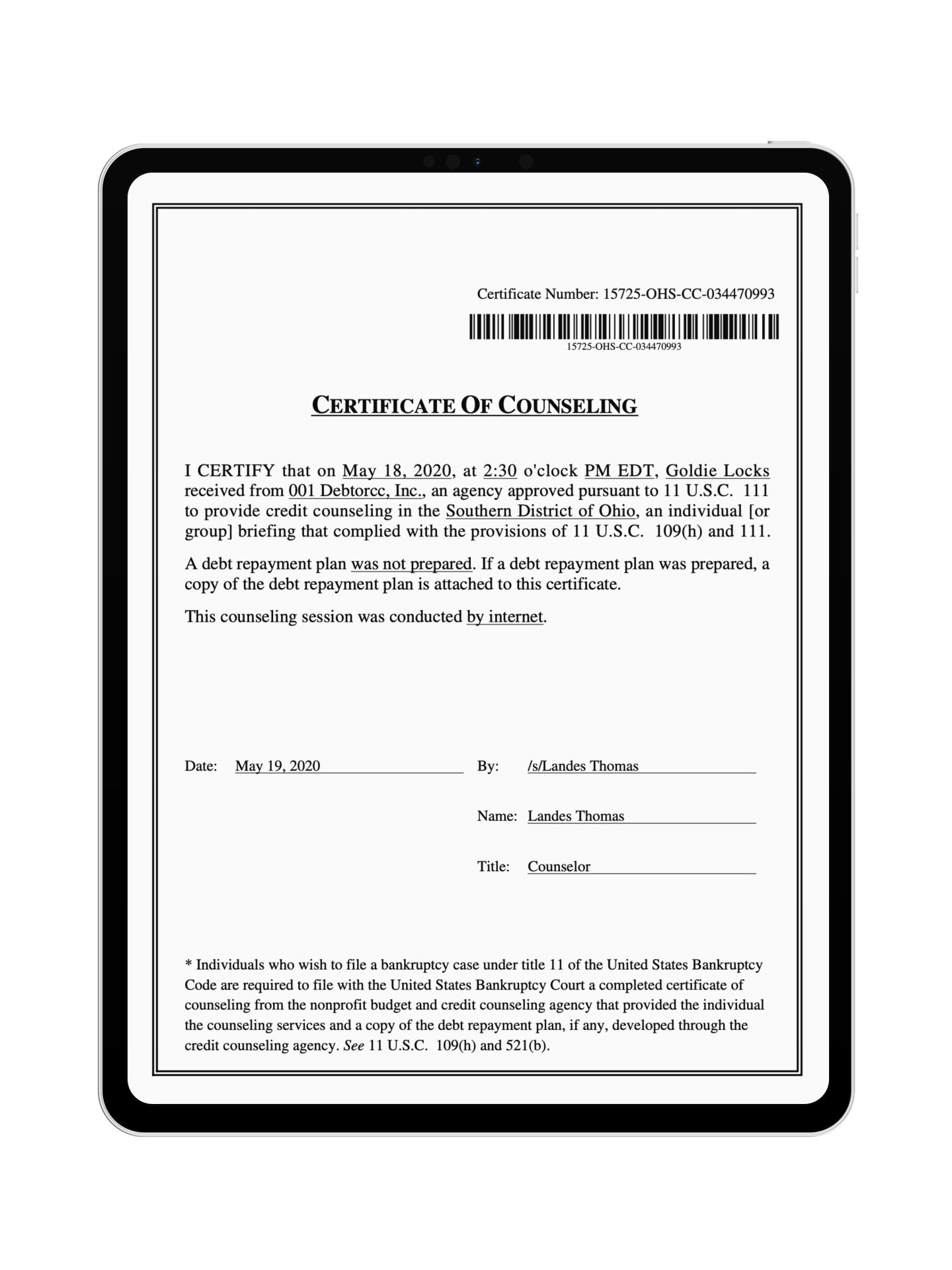

The completion date and credit counseling certificate will automatically populate into the applicable NextChapter case when they’re done. You can then download the certificate if you need to export it.

The certificate will be available to file with the bankruptcy case in NextChapter. Note that if a certificate has expired by the time you’re filing, NextChapter will alert you, helping you make sure that everything is complete and accurate.

Speed up the credit counseling process and simplify the process for you and your clients by taking advantage of the NextChapter and DebtorCC integration. Don’t get hung up on manual entry or lots of back and forth over email. Use the intuitive portal to communicate with your clients and ensure they get all requirements completed before filing.

Get started with our credit counseling course integration by reading this article or attending our upcoming webinar on June 25. We’ll be covering the DebtorCC integration, the new Custom Document Creator, and more enhancements within the software.